Where Excellence

Meets Execution.

Emerytus Advisors helps middle-market companies—public, private, and sponsor-backed—build the financial infrastructure they need to scale with confidence.

From growth strategy to technical accounting, internal controls to audit readiness, we bring clarity, structure, and forward momentum to complex financial and operational challenges. Our work sits at the intersection of execution and expertise—delivering insights that are not only right, but immediately actionable.

Emerytus was founded by senior leaders with real authority in the field—former Big Four partners and FASB executives who’ve shaped accounting policy, led high-stakes transformations, and stood shoulder-to-shoulder with companies in moments that matter.

They built Emerytus to raise the bar: to deliver hands-on support from elite professionals, practical solutions—not platitudes—and a commitment to helping clients move faster, think clearer, and operate with greater confidence.

The Emerytus Advantage

A New Standard for Professional Services

The professional services industry is at a crossroads. The drive for automation, efficiency, and scale has too often come at the expense of integrity, substance, and true client connection. At Emerytus Advisors, we’re choosing a different path—one rooted in human judgment, meaningful relationships, and a relentless commitment to excellence.

Integrity First: Saying Must Equal Doing

Trust isn’t built on words—it’s built on follow-through. We don’t overpromise or hedge. We do what we say, and we hold ourselves accountable to the commitments we make. Our word is our contract, and our actions are the measure.

Merit Over Mediocrity

Excellence is earned, not claimed. We value experience, sharp thinking, and sound judgment over shortcuts or volume. Our clients rely on us because we bring rigor, discipline, and a deep sense of responsibility to every engagement.

Personalized Service: Beyond Transactions

No two clients—or challenges—are the same. We invest the time to listen, understand, and tailor our approach. This isn’t about templates or playbooks; it’s about crafting solutions that reflect each client’s unique needs, goals, and context.

Relationships, Not Just Results

We deliver results—but never at the expense of relationships. Our work is built on trust and collaboration, not transactions. We aim to be long-term partners, not one-time fixers. When clients call us, it’s because they know we’ll show up—with clarity, urgency, and care.

A Higher Standard

Professionalism isn't a buzzword— it's our baseline. We show up prepared. We communicate clearly. We own outcomes. In an industry that's often drifting toward the impersonal, we stay grounded in competence, ethics, and respect for those we serve.

This is our commitment. This is Emerytus.

And this is the standard we uphold—every day, with every client, and in every interaction.

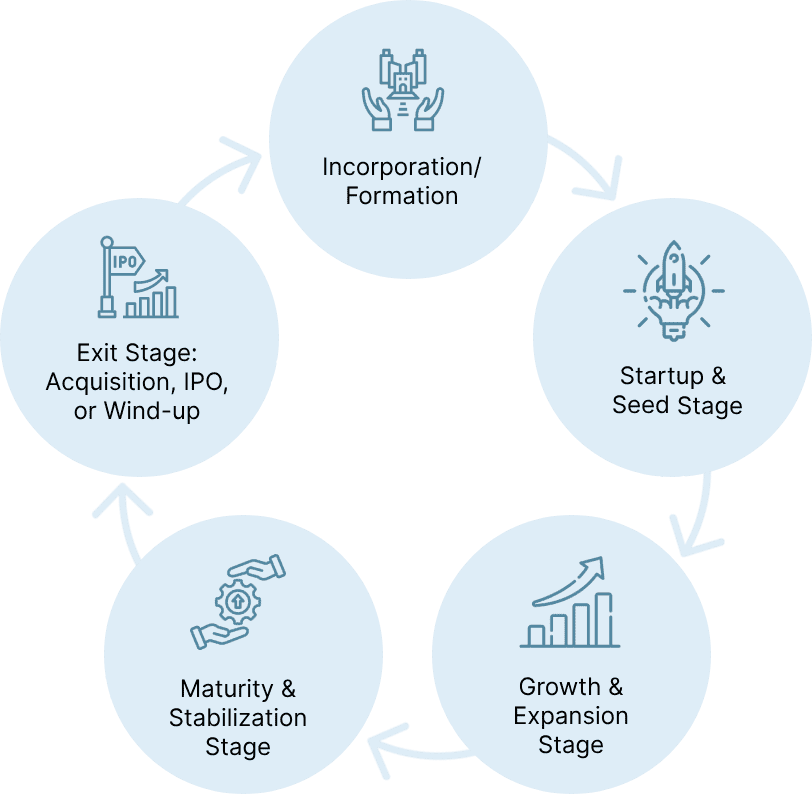

The Corporate Lifecycle

Who We Serve

Emerytus Advisors partners with middle market companies across the public and private spectrum—including sponsor-backed businesses navigating high-growth or transformational change. We work closely with CFOs, Controllers, Audit Committees, and Boards who need more than just advice—they need a team that can lead, execute, and elevate the finance function. Our clients span industries but share a common need: trusted experts who can step in and deliver clarity when the stakes are high.

When We Engage

We’re brought in at critical inflection points—before an IPO, after a transaction, during restatements or auditor transitions, and anytime internal finance teams are stretched beyond capacity. Whether you’re facing complex technical accounting issues, remediating internal controls, or preparing for a first-time audit, we deliver structure, speed, and stability when it matters most. Clients rely on us when timelines are short, expectations are high, and failure isn’t an option.

How We Deliver

We embed quickly, work shoulder-to-shoulder with your team, and take ownership from day one. Our model is hands-on, high-accountability, and built for execution—not endless planning. Led by former Big 4 partners, FASB insiders, and senior finance executives, we bring the judgment, technical depth, and operating acumen to move fast without cutting corners. We integrate seamlessly, communicate clearly, and leave behind stronger teams, better systems, and measurable results.

Insights from Emerytus Advisors

Top 5 Things to Know Before Structuring Your Next Debt or Equity Deal to Avoid Common Pitfalls

Raising capital—whether through debt, equity, or hybrid instruments—is a pivotal moment for any business. But too often, organizations focus heavily on legal and commercial terms while overlooking the…

→Accounting for Joint Ventures in the Energy Sector (ASU 2023-05): Key Changes and Implications

Introduction In August 2023, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2023-05: Business Combinations—Joint Venture Formations (Subtopic 805-60). This ASU addresses a long-standing deficiency…

→Preparing for 2026: What CFOs and finance teams need to know about the FASB’s latest disclosure overhaul.

Introduction In March 2024, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update 2024-03 Income Statement—Reporting Comprehensive Income: Expense Disaggregation Disclosures (Subtopic 220-40): Disaggregation of Income Statement…

→Complexity is Inevitable. Confusion Isn’t.

We help finance leaders bring order to chaos and move forward with confidence. Let’s connect and start a conversation with today.